The PCI Fibres Conference 2013 will take place November 7 and 8 at the JW Marriott Hotel, Pacific

Place, in Hong Kong. Topics include the supply of the various fiber raw materials and the situation

in the Asia-Pacific region.

The PCI Consulting Group, of which PCI Fibres is a founding member, is an association of

companies, each focusing on a particular area of the fibers and intermediates industry. Together,

the companies provide integrated consulting services covering the fibers and intermediates chain

and the related plastics industries, with a perspective ranging from refinery to finished product.

For many years, PCI Fibres leaders have been appreciated lecturers presenting the latest fiber

trends at the annual International Textile Manufacturers Federation (ITMF) conferences. Once a

year, PCI organizes its own conference, this time in Hong Kong.

Program Targets Marketing Issues

The conference will feature speakers discussing various markets for acrylics, carbon, nylon,

polyester, polypropylene, elastane and viscose; as well as their primary feedstocks and

intermediates. The program specifically targets marketing issues. Topics to be covered through a

number of papers include the supply of the various fiber raw materials, including polyester

recyclate. Some specific topics to be covered include, among others:

- fibers review;

- nylon 6: value chain — key developments;

- the new consumer market;

- economics and strategic review;

- nylon fibers: global segment opportunities;

- new developments for carbon fiber in the automotive industry;

- polyester staple markets in the Americas;

- consequences of China’s cotton policy on man-made fibers; and

- prospects for caprolactam.

Coverage also will include a discussion of wool from a prominent industry expert and of cotton

from a PCI Group expert. In addition, a prominent commentator from Hong Kong will provide a

strategic view. A panel discussion on the supply chain from feedstock to fiber and a workshop

covering the topic of excess fibers capacity and its resolution will round out the conference.

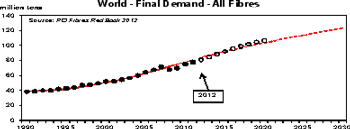

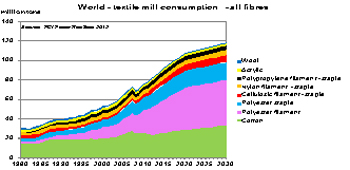

Growing Global Fiber Demand

According to the latest edition of the PCI Fibres Red Book, titled “World Synthetic Fibers

Supply/Demand Report 2012,” global demand for all forms of textile fiber, both natural and

manufactured, grew in 2012 by 4 percent to 82.1 million metric tons (mt), including 1.06 million mt

of wool — down by 2.5 percent, 22.9 million mt of cotton — down by 2.2 percent, and 58.2 million mt

of man-made fiber — up by 6.8 percent. Among man-mades, demand was lower for acrylic, nylon staple

and carpet yarn; while cellulosic staple demand grew by 19 percent, and nylon and polyester

filament grew by almost 9.5 percent.

PCI reports that in spite of increasing uncertainty worldwide with regard to economic

recovery, it projects that demand across all fiber types will grow a little more strongly in 2013 —

by 4.5 percent to an estimated 85.8 million mt. Wool is expected to recover by about 2 percent and

cotton by nearly 4 percent, while man-made fibers will grow by a further 5 percent.

The survey covers both consumer demand and textile mill consumption for wool, cotton and the

manufactured fibers. The analysis breaks the world into 13 regions, and also looks at capacity and

production for the primary man-made fibers — acrylic, nylon and polyester — in approximately 70

countries.

Since 2001, global fibers demand has registered a 4-percent average annual growth. Global

fibers demand for 2013 is projected to grow by as much as 4.5 percent, and PCI does not expect that

rate to ease until 2015, by which time it expects China’s demand pattern will be better defined and

there should be lower impact stemming from monetary stimulation around the world.

China In The Focus

Not surprisingly, discussions on China are likely to dominate the conference in Hong Kong.

According to PCI estimations, the Chinese market now accounts for 30 percent of worldwide consumer

demand for fibers and 53 percent of worldwide textile activity. It accounts for 33 percent of

worldwide mill consumption of wool; 35 percent of cotton consumption; and 61 percent of

manufactured fibers consumption.

Beyond 2020, PCI projects that China’s consumer market share will shrink in the face of

weakening Chinese demand and stronger growth in other markets. However, China continues to be a

major investor in new capacity vis-à-vis raw materials, fibers and textiles.

“But there are concerns that China’s consumer market for fibres products, if considered on an

‘apparent’ basis as the net of production and exports, might be over-heating,” PCI Fibres reports. “

Per capita demand in China for 2012 is put at 18.4 kilograms (kg) versus a global average of 11.7

kg, with South Korea at 21.3 kg, Taiwan at 21.1 kg and Japan at 21.0 kg. Can China as a whole

overtake these markets in the near future, or are its figures, particularly for man-made fibers,

inflated by over-investment? And if any correction is to take place, will this be by a reduction in

Chinese fibres production, which could throw the global petrochemicals industry out of balance, or

by an increase in exports, which could affect textile activity throughout the developing world,

especially in South-East Asia?”

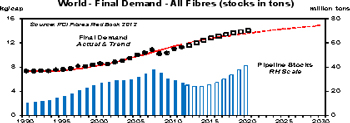

About PCI Fibers

PCI Fibres provides monthly, quarterly and annual reports covering the major manufactured

fibers and raw materials for acrylic, nylon, polyester and viscose as well as related products. The

modeling system applied tries to make allowance for the ups and downs of stock levels along the

supply chain. Material in this pipeline is only visible with any ease in the early stages of

processing before being converted into other products such as apparel. Everything at the industrial

level might point to a market moving purely in line with apparent demand, but stock-movement along

the pipeline, sometimes involving vast quantities, can be extremely influential.

PCI Fibres is a founding member of the PCI Consulting Group, which was formed in 1988 to

provide a comprehensive service on the markets for petrochemicals, fibre intermediates and related

industries. This scope was expanded to cover feedstocks, broader petrochemicals, related plastics

and the textiles industry.

Source: PCI Fibres

Graph 1

Click

here to view Graph 1 in a new window

Graph 2

Click

here to view Graph 2 in a new window

Graph 3

Click

here to view Graph 3 in a new window

August 27, 2013