Consumers Continue To Spend As Inflation Stays Under Control;

Federal Reserve To Raise Short-Term Rates

The most recent economic reports show that the U.S. economy is still strong. Consumers continued

to spend freely, while inflation is still well under control.

Despite zero inflation in May, the Federal Reserve is expected to raise short-term rates by a

quarter point.

The unemployment rate fell in May to 4.2 percent, matching the March rate, which was the

lowest in 29 years. Despite the drop in the jobless rate, the U.S. economy created 11,000 non-farm

jobs, following April’s surge of 343,000. Employment continued to shrink in manufacturing falling

by 45,000 jobs in May.

Moreover, the new data show that job growth is moderating. In the first five months of this

year the average monthly gain has slowed down to 196,000 jobs, falling short nearly 50,000 from the

pace in the second half of 1998.

The Producer Price Index for finished goods rose 0.2 percent in May after surging 0.5 percent

in April. The index for finished goods, excluding food and energy prices, was up just 0.1 percent

in May.

Consumer prices were unchanged in May, after jumping 0.7 percent in April. The core inflation

rate, which excludes the volatile food and energy prices, was up just 0.1 percent, allaying fears

of a buildup in inflationary pressures created after April’s 0.4-percent surge.

Industrial Production Rises; Housing Starts Rebound; U.S. Trade

Deficit Unchanged

Industrial production rose 0.2 percent in May following gains of 0.4 percent in April and 0.7

percent in March. Output of utilities dropped 2.2 percent after rebounding 4.9 percent in April.

Factory output grew 0.4 percent in May in line with growth of the previous three months.

The operating rate held steady at 80.5 percent for the third month in a row. The utilization

rate for factories was 79.7 percent in May, up slightly from 79.6 percent in April. Despite a tight

labor market, with an operating rate well below its long-term average of 82.1 percent, and with

downward price pressures coming from imports, there is no threat for higher inflation.

Housing starts rebounded 6.3 percent in May, to an annual rate of 1.676 million units, but

remained below the March 1.746 million level. The strength was in single-family units, which jumped

to 1.409 million from 1.249 million in April.

The U.S. trade deficit of $18.94 billion in April was virtually unchanged from a record

$18.95 billion in March. Exports rose 1.2 percent to $78.01 billion the first in six months, while

imports increased 1 percent to $96.95 billion.

Business inventories grew 0.2 percent in April, while business sales slipped 0.1 percent in

April. As a result, the inventory-to-sales ratio edged up to 1.36 in April from 1.35 in March.

Textile Payrolls Continue To Come Down; Sales By Textile Producers

Soar; Inventories Rise

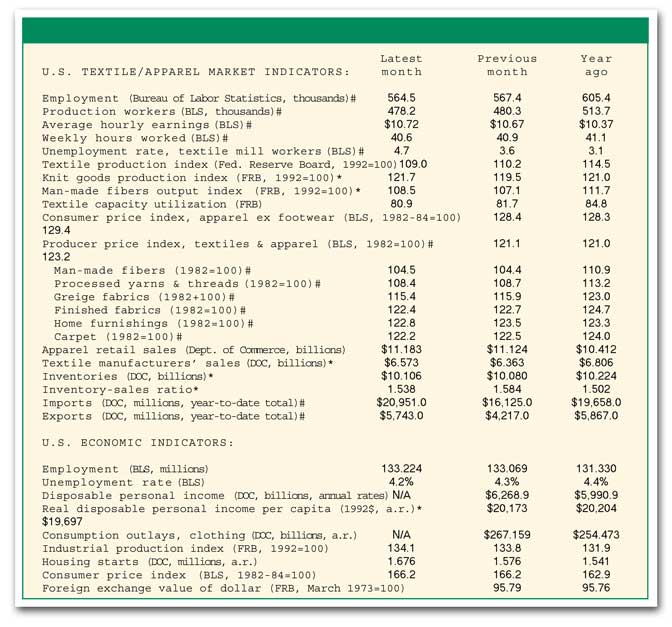

Results for textiles and apparel were mixed. The industry’s payrolls continued to come down

falling 0.5 percent in May and 0.3 percent in April.

The jobless rate for textile mill workers jumped to 4.7 percent in May from 3.6 percent in

April. Sales by textile producers soared 3.3 percent in April, after easing 1.0 percent in March.

In the meantime, inventories rose only 0.3 percent in April. Thus, the ratio of inventory-to-sales

dropped to 1.54 in March from 1.58 in March.

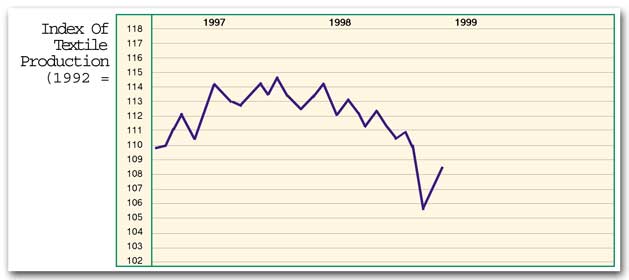

Textile output tumbled 1.1 percent in May, after rising 2.3 percent in April. The operating

rate for textiles dipped to 80.9 percent from 81.7 percent in April.

With a strong job market, still low interest rates and rising overall stock prices, consumers

have no reason to slow down spending.

Retail sales surged 1.0 percent in May after gaining 0.4 percent in April. Without autos,

spending was up 0.5 percent in May. Apparel and accessory stores sales gained 0.5 percent after

advancing 1.9 percent in April.

Producer prices of textiles and apparel edged up 0.1 percent in May. Also, prices inched up

0.1 percent for synthetic fibers.

Prices fell 0.2 percent for finished fabrics and for carpets, declined 0.3 percent for

processed yarns and threads, dropped 0.4 percent for gray fabrics and took a 0.6-percent dive for

home furnishings.

July 1999