W

hen the American Textile Manufacturers Institute (ATMI) holds its 54th annual meeting,

April 3-5, in Coral Gables, Fla., it will be a much different organization than in the past. Once

recognized as the US textile industry’s central trade association and its voice in Washington, the

ATMI of today is one of at least four organizations involved in lobbying for the textile industry

in the capital. In its heyday, ATMI had a staff of 35 and 19 committees dealing with a wide range

of issues affecting the industry, including communications, consumer affairs, cotton and wool,

environmental preservation, safety and health, human resources, home furnishings, economic

information, and international trade and market development. Hundreds of industry executives served

on various committees and subcommittees.

However, deteriorating business conditions, bankruptcies of some of its largest members and

defections for other reasons have resulted in a sharp decline in ATMI’s revenues and in major staff

reductions. Over the past two years, the staff has been reduced to 11. ATMI currently has 13

committees, including four new ones created to address issues related to specific product

categories – apparel fabrics, home furnishings, industrial fabrics, and yarn and thread. This past

year, ATMI announced plans to create a bed and bath division to deal with issues such as

flammability, copyright protection and country-of-origin issues, and to provide economic

information and analyses specifically related to bed and bath products.

Historically, ATMI’s greatest strength has been its committees and the active involvement of

its member companies and individual executives. That strength continues today, although with fewer

people from the industry and a smaller staff. One significant change at the annual meeting is that

Carlos Moore will be leaving after 22 years of service as international trade director and

executive vice president.

Parks D. Shackelford, a former congressional committee staffer and US Department of

Agriculture official, took over as president and chief staff officer in July 2002. Shackelford sees

ATMI as an organization “in transition,” brought about as a result of the contraction of the

domestic industry and major changes that will result when import quotas are removed by January

2005. “We are in a period of change, and how we react to that change and how successful we are in

shaping that change is crucial to the future of our industry,” Shackelford told

Textile World

. He says ATMI’s overall mission is to continue providing the industry with a wide range of

services, with particular emphasis on influencing government regulatory issues and international

trade policies.

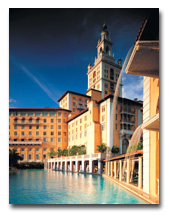

The Biltmore Hotel in Coral Gables, Fla., will host the 54th annual ATMI meeting, April

3-5.

A Voice In Washington

While ATMI traditionally has been the textile industry’s voice in Washington, where

international trade is concerned, it now shares that responsibility with a number of other

organizations. However, ATMI is the only organization with a full-time staff based in Washington.

In most cases, the other organizations represented in Washington have the same general

international trade goals as ATMI, but in the past, and to some degree today, they also have some

policy differences. An indication of these differences was seen in the final House vote granting

Trade Promotion Authority (TPA) to the president last year, when 18 House members from what are

considered solid textile districts voted for it and 18 opposed it.

While there were extenuating circumstances in some cases, the votes do reflect some policy

differences within the various organizations lobbying on textile issues. One relatively new

organization working the halls of Congress and the administration, as well as the grass roots, is

the American Textile Trade Action Coalition (ATTAC), a consortium of some three dozen textile

companies and the labor union UNITE, formed in April 2002 with the leadership of Roger Milliken,

CEO and chairman, Milliken & Company, and Bruce Raynor, UNITE president. ATTAC’s members

include Milliken & Company, Cranston Print Works and other former ATMI members that have had a

parting of ways with ATMI over international trade issues. Through the union, ATTAC draws on the

support of some 300,000 workers across the nation. ATTAC has its own agenda dealing with a broad

range of issues that go above and beyond, and sometimes in different directions than, what ATMI is

doing.

Another newcomer to the scene is the National Textile Association (NTA), created by the

merger of two long-standing textile organizations, the Northern Textile Association and the Knitted

Textile Association

(See ”

Textile

World News,” September 2002). NTA represents 191 textile producer and supplier companies

making a broad range of products. NTA is represented in Washington by Auggie D. Tantillo, a veteran

textile lobbyist and former Senate staffer, who also is the Washington rep for ATTAC.

Another relative newcomer, formed in 1998, is the American Textile Alliance, an umbrella

organization of 17 fiber and textile trade associations. Gaylon Booker, president and CEO of the

National Cotton Council, is its chairman. The basic purpose of the alliance is to bring the various

segments of the industry together and to seek areas of agreement in the hope they can speak with

one voice in dealing with Congress and the administration on trade issues. The alliance and its

members meet regularly with congressional supporters from the textile/fiber states and with

administration trade officials. Because the alliance has a much broader base of support, including

ATMI, it is in a better position to accomplish more than ATMI could by itself. It also serves as a

forum in which various segments of the industry can try to resolve differences internally, so they

can present a united front in dealing with Congress and the administration. The alliance’s current

efforts are aimed at seeing that the Bush administration follows through on its commitments made in

2002 to address the textile industry’s economic and international trade problems.

ATMI President Parks D. Shackelford (left) and Incoming ATMI Chairman Willis C. Moore,

executive vice president and CFO, Unifi Inc.

Congress And The Administration

There is little doubt that ATMI continues to be an effective voice in dealing with Congress

and administrative and regulatory agencies. In its work with key agencies such as the Consumer

Product Safety Commission, the Environmental Protection Agency, the Occupational Safety and Health

Administration and the Federal Trade Commission, ATMI, with the help of its members, is able to

provide information that has helped shape rules and regulations impacting the industry. With the

Bush administration more inclined to address problems with voluntary programs and to put more

emphasis on its regulations on scientific and economic impact information, this is a real plus for

ATMI.

With respect to international trade, where ATMI devotes most of its resources, the picture

is not so bright. There is no question that it is in a weaker position than it has been in the

past. This is due to a number of factors. First and foremost is the fact that as the industry

continues to shrink, members of Congress as a whole and administration officials are less inclined

to place high priority on its problems. However, it must be said that, at least up to this point,

the Bush administration remains committed to addressing the industry’s economic and international

problems. Much of this is due to constant pressure from textile state members of the House and

Senate, as well as from ATMI and other organizations. An emerging development that could help

bolster the textile industry’s support in Congress is the fact that other manufacturing industries

are finding they share some of the same international trade problems that textiles have faced for

so long.

ATMI has been a major moving force in the Coalition for a Sound Dollar, comprised of several

major manufacturing industries that are at a competitive disadvantage as a result of being hurt by

the strong dollar and currency manipulation by Asian nations.

ATMI has also organized the US Industrial Base Coalition for Military Readiness, which is

working to preserve and expand the so-called Berry-Hefner amendment that requires defense-related

industries to buy American-made products.

The textile industry lost a lot of clout in the Senate with the retirement of Senators Strom

Thurmond and Jesse Helms, who together had a combined 77 years of seniority and service. Helms, in

particular, used his seniority and parliamentary skills to block legislation the textile industry

didn’t like and to put pressure on several administrations to respond to the industry’s needs.

Also, as a result of last year’s election giving Senate control to the Republicans, Sen. Fritz

Hollings (D-S.C.), one of the industry’s strongest and most effective supporters, lost his Commerce

Committee chairmanship, and presumably some of his clout.

On the House side, ATMI continues to work closely with loyal supporters in the Congressional

Textile Caucus. While the caucus remains effective, fewer members actively participate in it, and

those who remain active, with the exception of Rep. John Spratt (D-S.C.), are not in major

leadership positions. Those members of Congress who hold leadership positions on committees such as

Ways and Means, which initiates trade legislation, are pretty free-trade-oriented.

At the same time this is happening, retailers and other importing interests are pouring huge

amounts of money and people into their efforts to promote free trade in textiles. They are much

more visible and active in Washington than ever before, and they are operating in a climate that

down the road is likely to be more favorable to their interests.

Non-Trade Issues

While ATMI has had to scale back its operations, it continues to focus on fewer, but still

important, areas of government regulation. It carefully monitors regulations and provides input

during the periods when government agencies are proposing new or expanded regulations. It continues

to analyze economic information related to textiles and is a valuable source of information for

government agencies, members of Congress and textile companies. It continues to serve as a reliable

information source for the news media nationally and in the textile states, and it publishes a

product directory that helps potential customers find suppliers among its member companies.

On the eve of its 54th anniversary, ATMI certainly is different, but so are the textile

industry and its issues, as they both face up to what industry leaders describe as “profound

changes” at home and abroad.

Van May Sees Progress On Textile Trade Issues

When Van May was elected chairman of ATMI last April, he knew it was not going to be an easy

job. The textile industry was in a tailspin; there were widespread plant closings and job losses;

and imports continued their relentless rise. While the industry was encouraged by a promise made by

Commerce Secretary Donald L. Evans at last year’s ATMI annual meeting to “level the playing field

internationally,” the industry faced a major challenge in seeing that those commitments were met.

At the outset, May and other leaders of ATMI decided to focus on what they saw as the “inherent

unfairness of trade today.”

“We were able to highlight a number of specific instances where our foreign competitors have

unfair advantages, many of which have been agreed to by past trade negotiators from this country,”

May said. “Most officials I visited with ultimately had to acknowledge that the game is unfair. I

think getting that acknowledgment and spreading that word outside of traditional textile circles is

critically important to ultimately developing solutions.”

Chief among the industry’s accomplishments was the formation by the Commerce Department of

interagency working groups, in which May says key government officials from different agencies of

the government are “officially focusing” on the industry’s international trade and economic

problems and are seeking solutions to those problems.

Outgoing ATMI Chariman Van May

During the past year, the industry succeeded in getting an extension and improvement of the

Cotton Competitiveness Program through 2006. The new legislation removes 1.25 cents per pound of

cotton that US cotton consumers had to absorb before receiving payments offsetting the difference

between the world and US prices for cotton. It is estimated this will save the US textile industry

$50 million a year.

With respect to new preferential trade agreements, such as the free trade agreements with

Singapore, Chile and the Central American nations, it appears the US government is establishing the

yarn-forward country of origin rule supported by ATMI, which calls for inputs to come only from the

participating nations. However, the agreements do provide for a limited amount of inputs from third

countries. And in another critical area, the industry has been successful in fending off attempts

by other countries to accelerate the planned 2005 phase-out of textile and apparel quotas.

Textile manufacturers will benefit from tax legislation, supported by ATMI, that lengthens

the period for tax loss carrybacks. The legislation also provides for more generous tax treatment

for plant and equipment investments.

May sees some significant strides toward the long-sought goal of the industry to develop

consensus positions and to speak with one voice in dealing with the government. “We are much

stronger when we can speak with a larger and more unified voice. Our success in that regard was not

total, nor was it without some controversy as we attempted to meld disparate views into one.

Nonetheless, I think we have developed a good working relationship among several important groups

in our industry and within our government,” May said.

Looking down the road, May is concerned about what he sees as “the shortsighted vision of so

many who are willing to give away the industrial bases in this country.”

May said: “The first two-thirds of the history of this nation were spent desperately trying

to build an industrial foundation that would allow us to stand alone, independent of foreign

regimes that dominated industry in that time. Our ancestors did everything within their power to

develop an independent industrial base in this country. Now in the last few years, it seems many

cannot wait to give all of that away. That is economic folly and is incredibly short sighted. I

hope that during my year I was somehow able to influence at least some to take up the banner and

themselves begin to tell the story of unfair trade and the industrial demise it is creating.”

At ATMI’s 54th annual meeting in April, May will hand the chairmanship of the organization

over to Willis C. “Billy” Moore, executive vice president and CFO, Unifi Inc., Greensboro, N.C.

Editor’s Note: An in-depth interview with incoming ATMI Chairman Willis C. Moore will be

published in the May 2003 issue of

Textile World.

March 2003