R

ising raw material costs are adding to the list of mill woes. Both cotton and man-made

fibers now are running considerably above year-ago levels, putting new pressures on overall

industry profits and margins.

Looking at cotton first: Spot quotes for the natural fiber at last report, while down from

early-2008 highs, were still running close to 15 percent above a year ago. And signs seem to

suggest that this firming trend will continue as reduced plantings point to lower output. In any

case, new supplies won’t be nearly enough to meet estimated demand. Zeroing in on the United

States, production for the 2008-09 marketing year is now estimated at only 13.8 million bales –

down significantly from this past year’s 19.2 million bale total. With demand up fractionally, this

will lead to a big fall-off in year-end stocks. Best bet at this time: a more than halving of

end-stock totals to only 4.6 million bales. That’s the equivalent of only a 24-percent stock/use

ratio – again, roughly half the ratio reported for the just-ended 2007-08 marketing year. Global

supply is expected to be down 7 million bales at a time when consumption is projected to edge up

about 1 million bales. Ending stocks look to slip by an impressive 8 million bales. That should

push the global stock/use ratio down to near 40 percent, well under the near-50- percent reading of

recent years. Bottom line: a supply/demand scenario that would seem to suggest a better-than-ever

chance for some further modest cotton price increases in the months immediately ahead.

Cotton Isn’t The Only Problem

Rising costs of other textile inputs are proving equally disturbing to mills these days.

Such other natural materials as cashmere and leather also have been moving higher. Even more

important are the substantial increases that have been posted on many man-made constructions. To be

sure, supplies of these man-mades aren’t the problem. Based on latest estimates, capacity looks to

be more than sufficient to satisfy demand. Rather, the price increases in man-mades for the most

part are attributable to the recent huge cost advances in oil. In any event, such key man-mades as

polyester, nylon, rayon and acrylics have all been moving higher. And when these hikes are added to

the already noted boosts in other fibers, it becomes increasingly clear that rising material costs

can no longer be ignored. Just how much of a factor they are can be gleaned from the fact that the

material component in the basic textile mill sector accounts for nearly two-thirds of every sales

dollar. Add in the fact that

Textile World

editors expect these material costs to increase some 5 to 6 percent this year, and the

magnitude of the problem becomes even more apparent. Consider still other rising mill costs,

especially when it comes to transportation, and it’s easy to see why the industry, while still in

the black, has seen its profits and margins shrink substantially over the past few quarters.

Prices Rising, Too

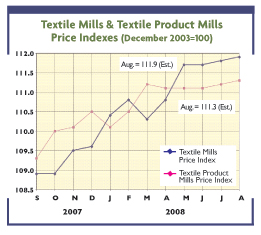

Given all these above-noted cost pressures, it’s clear why mill quotes are starting to move

up – even in the face of stiff-as-ever global competition and continuing strong resistance on the

part of clothing manufacturers and other downstream consumers. And these increases are starting at

the basic level. Fabric tags already are running some 2 percent ahead of a year ago. Boosts of

roughly the same magnitude are noted for the more inclusive textile mill and textile product mill

yardsticks shown in the chart.

The question, then, is not if prices will continue to rise, but rather by how much? Throwing

all the pertinent cost and other market information into the computer hopper,

TW

has come up with estimates that call for both major mill price indexes advancing another 1 to

2 percent before the year is out. This adds up to about 3- to 4-percent increases for all of 2008 –

well above last year’s small hikes. Even apparel averages – so far resistant to any meaningful

price hikes – should begin to edge higher. Other things being equal, all these price advances

should help prevent any further sharp near-term profit erosion. So should the fact that there is

little or no upward cost pressure in labor, which generally accounts for a sizeable 20 percent of

the textile sales dollar.

More on bottom-line mill performance next month when the latest profit margin projections

become available.

September/October 2008