It’s been a fairly good year for the U.S. domestic and apparel industries. Barring any unforeseen crisis, the small gains of the past 12 months should pretty much repeat themselves. More importantly, bottom lines also should continue to improve.

Credit much of this upbeat projection to a still-strengthening economy. There is now growing evidence to support solid macro-economic growth, with gross domestic product — the most inclusive measure of U.S. activity — expected to advance at a 3-percent or slightly higher annual rate. This rate is actually a bit above this past year’s advance, and the equally small increases of the previous few years.

Moreover, there’s plenty of evidence to back up this rosy forecast. Continuing low rates that should spur both household and business spending; the recent sharp drop in energy costs; big increases in net worth engendered by the Wall Street and housing recoveries; and probably, most important of all, improving consumer optimism as unemployment continues to edge lower.

The key point to keep in mind here: General economic growth is almost always the catalyst for stepped up textile and apparel activity. Historically, for example, every additional percentage point increase in GDP tends to result in a similar advance in the two industries’ production and shipment levels.

But there are also a lot of other factors contributing to today’s rosy outlook, including:

- Some import slowdown: True, incoming textile and apparel shipments rose a bit over the year just ended. But the gains were quite small and nowhere near the huge increases over the past decade.

- Rising overseas costs: Double-digit pay increases and substantially higher energy tabs have significantly reduced foreign competitor’s cost advantage. And at the same time, U.S. producer costs as a percentage of shipments have actually dropped dramatically.

- A growing interest in reshoring: Lower production costs plus other important advantages of producing closer to home are forcing firms to take a good hard look at bringing part of the U.S. production back to the United States, or at least closer to American shores.

- More innovation and improved marketing strategies: Every year, the industry seems to come up with a spate of new and improved ideas and products — especially where it involves nonwovens and technical products where usage gains run far ahead of traditional apparel and home furnishings products. And on the strategy front, market demand continues to be helped by increasing emphasis on “going green” and “Buy American.”

- Strong capital spending: Mills have continued to spend substantial amounts on new machinery and equipment — enough, they say, to assure both continuing increases in worker efficiency and more production flexibility.

- Rising profits: Combine a diminishing overall cost factor with today’s relatively stable prices — and it should come as no surprise that both industry earnings and margins have continued to improve.

- A more level playing field: Both Uncle Sam and the industry continue to press against unfair practices such as currency manipulation and illegal transshipments.

In short, the prognosis for the U.S. textile and apparel industries is becoming increasingly positive, with a more detailed outlook for the many subsectors of both industries shaping up something along the following lines.

Industry Demand Trends

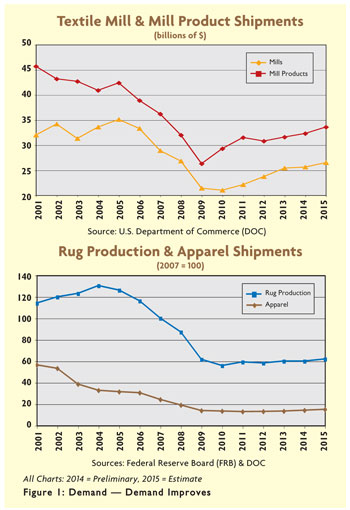

As noted above, another fairly good year now seems virtually certain. Overall mill shipments, for example, look to be up about 3 to 4 percent. That’s actually some improvement over the 1-percent-plus advance noted over the past 12 months.

Basic mill products (fibers and fabrics) will lead the increase. But more highly fabricated items (carpets, household furnishings and industrial products) also should begin to edge up at a faster pace after their essentially flat 2014 pattern.

Credit this latter improvement to two factors — the likelihood of another good auto year and expectations that the housing market will be considerably stronger than it was last year.

On the latter score, strong housing should mean more demand for rugs and carpets. It will be a welcome change from the past four years when sales of these products remained virtually unchanged.

Indeed, compare current demand levels to those recorded just before the 2008 business downturn, and one finds that the past year’s sales barely totaled 1 billion square feet — down some 4 percent from the prerecession level.

But as suggested, better days lie ahead. Company executives would seem to agree as they announce stepped up investments aimed at producing new and better carpet products, as well as increasing output efficiency.

Nonwoven fabrics also are doing quite well. Strong growth can be expected to continue in such areas filtration, protective apparel, roofing and geotextiles.

And the same can be said for fabrics designed for activewear. According to a recent Cotton Inc. survey, for example, more than nine out of 10 consumers say they now wear activewear for activities other than exercise. Not surprising, sales are growing at double the rate noted for non-activewear.

The denim market also remains bright. According to one style expert, the young generation who grew up with skinny jeans now are also discovering 100-percent cotton denim. And a new wave of people is expected to wear traditional designs again.

Add in all other clothing products, and overall apparel shipments are likely to rise another 5 percent or so over the New Year. Behind the optimism: The combination of positive consumer buying factors that were discussed previously.

Finally, before leaving the subject of demand, a few words are in order on our shipment versus production numbers. Normally, differences occur because production is a physical concept, while shipments always are expressed in dollar terms. But no such differences are noted this time around. Expected changes will be pretty much the same because prices are expected to remain quite stable.

Ample Supplies Assured

One thing for sure, U.S. domestic producers should have no problems in meeting the above demand estimates. For one, industry capacity is more than adequate. But equally important is the fact that overseas suppliers, often in dire need of American dollars, should remain both willing and able to fill any and all orders.

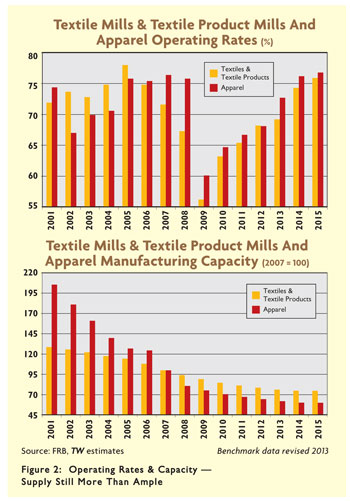

Looking at domestic mill capacity first, production potential over recent years has continued to decline. But these cutbacks generally have been a lot more modest than recorded a decade or so ago. Result: It has been increasingly difficult to significantly raise mill utilization rates despite the modest recent pickup in demand.

In late 2014, for example, domestic mills were operating at only around 74 percent of their potential. True, that’s an increase of 5 percentage points from 12 months earlier. On the other hand, it’s still well under preferred levels. And it’s much the same story in the domestic apparel sector where a 3.5-percentage point rise in utilization over the past year — to only 76 percent — has left U.S. clothing manufacturers with a similar problem.

To put all this in proper perspective, these current utilization rates are nowhere near the 85 percent and higher levels prevailing in the late 1990s just before the huge Chinese import wave hit.

But imports aren’t the only reason for current excess capacity. Another key factor is the need for more efficient capacity in order to survive today’s strong international competitive pressures. Indeed, that’s the major reason why our domestic mills last year spent upwards of a billion dollars on new plants and equipment despite less-than-desired demand.

Moreover, there’s increasing evidence that the new year will see a continuation of this strong capital spending. Thus, as reported in recent TW issues, new plant and equipment spending is widespread — embracing the broad spectrum of mill activity including fibers, spinning, nonwovens, composites, technical fibers, floor coverings and textile chemicals.

Not surprising then, the amount of money being earmarked for this purpose isn’t all that much different from the capital spending totals of 5 to 10 years ago when the industry was a lot larger.

Viewed from another perspective, TW estimates that some 2.2 percent of a mill shipment dollar now is going for new investment — actually a bit bigger percentage than a few years ago. It’s a pretty good indication that company executives are backing their views of a still buoyant industry with impressive cash infusions.

One thing for sure, all this new investment — even with continuing closures of old plants — is bound to keep mill utilization rates well under preferred levels for several more years.

The Import Impact

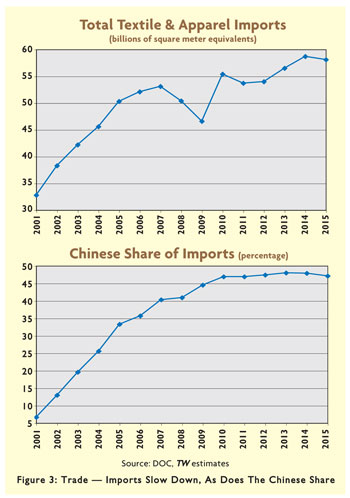

All these supply and demand trends, of course, will be influenced by incoming shipments from abroad — shipments that will continue to account for the lion’s share of U.S. textile and apparel demand. But on a somewhat more positive note, TW is convinced that the big domestic losses of past years are over.

The big question, of course, is how long will it take to even partially recoup lost markets? Clearly, it’s unrealistic to expect miracles. Note, for example, that while our small share of the market has stabilized, there still is no statistical evidence of any big near-term shift back to U.S. shores.

On the other hand, it’s likely that there will be some gradual improvement. At least that’s the view of The Boston Consulting Group, Boston. A new survey by the firm finds that executives of American industries, including textiles and apparel, see their share of the overall U.S. market increasing by about 7 percent by the end of the decade.

True, that’s hardly earthshaking. But it’s a major shift from the share declines noted over the past decade or two. One indication of this changing pattern in the textile and apparel sector can be seen in Figure 3, which shows imports from China flattening out after the huge gains racked up in the 2000-2009 period.

Actually, several factors are behind this Chinese change — namely high overseas energy tabs, rapidly rising Beijing labor costs, and the substantial appreciation in the value of the yuan over the last few years.

Other things being equal, the latter development has worked to make Chinese-made goods a little more expensive for American buyers. Indeed, so have the double-digit pay hikes the Chinese manufacturers have been facing over the same extended period.

Throw all the upward-tugging overseas price factors into the computer hopper, and an important slowdown is clearly indicated. Incoming 2015 shipments of textile and apparel are expected to show a small 1-percent decline, with perhaps somewhat larger 2- to 3-percent slippages showing up over the following few years.

Finally, while on the subject of trade, some comment also may be in order on U.S. exports of these products. The big news here is that outgoing shipments have been inching ahead now for five straight years. Result: The still-huge textile and apparel trade deficit now may also be ready to top out.

Fiber Costs Ease

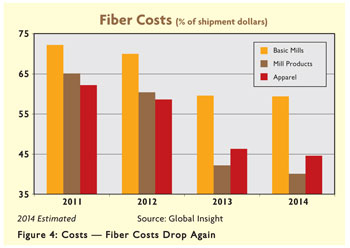

Further upbeat news comes from fiber costs, especially cotton, which have dropped significantly over recent years. This can best be appreciated by glancing at Figure 4 where costs as a percentage of the average mill and apparel shipment dollar have been declining for three straight years.

Over this period, material outlays as a percent of shipments in the base mill product area have dropped from 72.2 percent to just 59.4 percent. For more highly fabricated mill products, the fall was from 65.1 percent to only 40.1 percent. For apparel, the peak 2011 percentage of 62.2 percent has slipped to only 44.6 percent.

Moreover, based on TW’s new projections, 2015 should see further dips. Again, credit continuing weak cotton quotes, though man-made also could slip a bit.

Looking at cotton first, prices — which have been edging lower from the $2-plus peak of 2011 — could well continue to do so over the new year as supplies continue to outpace consumption. On the output side, for example, current projections for the 2014-15 marketing year point to another big global crop of 120 million bales.

On the other hand, world usage is put at only near 114 million bales. This supply-demand differential means that the current year’s ending stocks could rise to near 107.5 million bales.

To put this glut into proper perspective, this is the equivalent of near 94 percent of a year’s supply. Compare that to the under 50-percent reading of 2010-2011, and it’s easy to see why prices have tumbled and are expected to remain shaky over the next few quarters.

Finally, there’s still another factor operating to keep the natural fiber’s price down: China’s huge stockpile — the equivalent of a monstrous 1.65 year’s supply. Such an unprecedented hoard hanging over the market could be a major factor in inhibiting the fiber’s recovery.

The expectation of market softness also applies for man-made fibers. To be sure, prices have remained relatively stable lately. But this may well change into some scattered uneasiness over the upcoming year.

Once again, global oversupply is one of the key reasons. Take polyester, where the combined filament and staple utilization rate is now put in the low 70- to 72-percent range.

Moreover, still more polyester capacity is scheduled to come on stream, thus preventing any meaningful improvement in utilization rates. Similar supply/demand imbalances likely are to continue in other man-made fiber areas.

But oversupply isn’t the only factor putting a lid on man-made quotes. Remember that man-made feedstock costs depend on energy trends. So given recent hefty declines in gas and oil tags, these feedstock costs should remain under market pressure.

Finally, it should be pointed out that man-made prices have a long history of not rising. In fact, they have inched up less than 1-percent annually over the past three decades. As just indicated, there’s little to suggest any change in this pattern.

No Labor Problems Either

The industry’s other major cost component, labor, also is pointing to better days ahead. Again, two major factors are operating here. Pay hikes that remain quite modest; and continuing productivity gains, which in most cases are offsetting the impact of any higher pay rates.

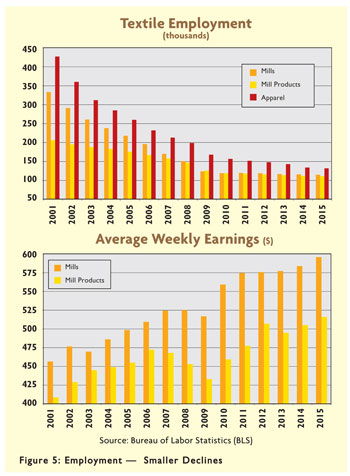

As far as pay increases are concerned, the advance reported by Uncle Sam’s Bureau of Labor Statistics has been surprisingly small. On the mill level, the average weekly paycheck has gone up only about 1 percent over the past year, with the gain in the apparel sector put at only a slightly larger 2-percent rate.

Worker efficiency, meantime, has been rising at the same or even slightly faster pace. According to the National Council of Textile Organizations (NCTO), mills have increased their productivity by 24 percent over the past 10 years, making textiles one of the top industries as far as boosting efficiency is concerned. Expressed on an annual basis, it means mill productivity has been rising at a better than 2-percent annual rate.

Credit these gains to recent billion-dollar-plus plant and equipment expenditures alluded to earlier — virtually all of which has contributed to the streamlining of the industry — making it both more efficient and a lot more flexible.

In any event, it’s clear that these efficiency improvements are pretty much offsetting pay hikes — to the extent that unit labor costs have not been rising and may have even dropped fractionally.

And there’s every indication that this trend toward greater efficiency is continuing. Over the past year or so, TW calculations suggest that the industry efficiency advance may now be closer to 3 percent.

That’s a performance many other industries would find hard to match. And more importantly, it’s a positive sign for U.S. mills when compared to China where previously noted double-digit pay hikes have far outweighed any modest productivity gains that country may have achieved.

Meantime, about the only negative impact of the strong efficiency gains is that they are pretty much the reason why textile and apparel employment numbers have continued to drop. True, the huge import influx of the past few decades also has been responsible for much of the decline. But without the efficiency factor, the slippage would have been much less precipitous.

Thus eliminate the 24 percent productivity gain noted over the past 10 years, and today’s employment would have been 24-percent higher. And it’s much the same when it comes to apparel. In any case, it’s the price the U.S. has to pay to keep its two industries competitive and prosperous.

This also invites questions about future job trends. The answer: Probably continuing small declines — most likely only in the 1- to 2-percent annual range as slowly improving demand provides more of an offset for continuing efficiency gains.

Finally, a couple of words on the role of textiles and apparel in the overall economy. Again, relying on NCTO estimates, U.S. textiles and apparel are two industries still to be reckoned with providing jobs for close to a half million workers, with each job supporting employment for another 3 workers. Not bad for a sector that many had written off as recently as five years ago.

Little Price Movement

The combination of supply, demand and cost trends just outlined suggests the recently flat price pattern will persist. And this lack of any inflationary pressure would seem to apply at all levels — fibers, fabrics, more highly fabricated textile products and, of course, apparel.

On the apparel front, while overall price averages last year remained virtually unchanged, some product lines actually weakened. That’s especially true on the retail level where men’s and boy’s clothing slipped 2 percent vis-á-vis a year earlier.

Imports, of course, also have played a major role in keeping tags relatively stable. At last report for example, prices of incoming shipments of fabricated textile mill products lagged 1 percent behind a year earlier. That may seem surprising given the big increases in Chinese production costs discussed earlier.

However, the reasons behind this restraint aren’t too hard to find. They include: more source shifting to Third World countries where production costs are still lower than they are in China; the willingness of many foreign producers to accept lower profits in order to hold onto business; and the preponderance of commodity-type items in the import mix — products that by nature are the most competitive.

Note, too, that this basically flat price pattern, both here and abroad, is more than just a near-term phenomenon. The fact is that these quotes have barely budged for more than a decade. That’s a lot different from the overall 2- to 3-percent overall U.S. inflation rate reported over the same period.

The big question, however, is how long will this inflationless trend continue? Judging from new price projections from economic consulting firm Englewood, Colo.-based IHS Inc., this relatively stable trend can be expected to last for at least another three years. Over this period, the firm sees both textile and apparel inflation rates still remaining relatively unchanged.

Again, that’s considerably under the inflation rate projected for the entire U.S. economy. Other things being equal, this clearly provides consumers with continuing incentives to purchase clothing and other textile-related objects.

Better Bottom Lines

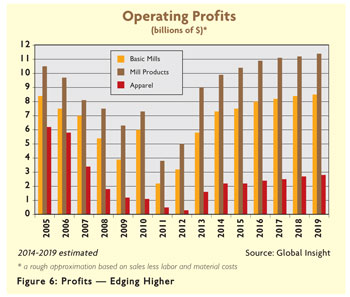

Add these relatively stable prices to the previously discussed demand, supply and cost trends, and it’s easy to see why profits have increased significantly. Latest government numbers, for example, would certainly seem to confirm these gains. Thus domestic mills’ after-tax profits in the third quarter 2014 — the latest data available — were running an impressive 27-percent above a year earlier.

Domestic apparel companies, meantime, have managed to maintain the higher levels reached in both 2012 and 2013.

A similar upbeat picture is seen for profit margins. Mill earnings per dollar of sales in the third quarter 2014 — 6.4 percent — topped that of a year earlier by a full percentage point. And apparel manufacturers managed to hold their return at a relatively high 10.5 percent. Focus on still another widely monitored profit margin concept — earnings per dollar of stockholders’ equity — and the picture is much the same in both industries. Indeed, in the mill sector, the latest return in equity actually topped that reported by a good many other U.S. manufacturing industries.

Also note that these returns on equity are a lot higher than those that can be earned by just stashing money away in a bank account. This could well be one of the major reasons why domestic firms continue shelling out big sums of money on new plants and equipment.

Looking ahead to the next few years, however, it would be unrealistic to expect further large earnings gains in as much as any further fiber cost declines and demand increases should be relatively modest.

This also is the feeling of IHS. Its forecast for mills making basic mill products, such as fibers and fabrics, calls for annual profit increases of only 2 to 2.25 percent over the next three years, with slightly higher increases possible for more highly fabricated textile products.

Proceeding further on downstream to apparel, the expected annual profit advance is put at an even more impressive 8 percent. Moreover, go further out into the future — 2018 to 2020 — and IHS analysts are betting on further modest creep-ups in both the mill and clothing sectors.

If anywhere near correct — and combined with small demand gains — these longer-term projections are a pretty good indication that the two industries should be more than holding their own in what is shaping up to be an even more competitive global marketplace.

Innovation: The Name Of The Game

Meantime, the ongoing drive to come up with new and better performing products also is helping propel the industry forward. And once again, it’s a virtually across-the-board effort — running all the way from basic fibers to final consumer and business products.

The aim is not only to increase sales, but also take advantage of the fact that, with the recession behind us, consumers now are more willing to upgrade to improved and often more expensive products. No surprise then over the ever-growing number of innovations aimed at increasing comfort, performance, safety and even ecological correctness.

Zeroing in on fibers first: While products involving cotton are in the forefront of these developments, most other constructions now are also offering a spate of improved offerings. Wool is a prime example here, as new merino types hit the market offering a durable, as well as ultrasoft, fiber that’s virtually itch free. It’s already being used in such items as undershirts, shirts and hosiery.

Even silk is coming up with some upgrades. Take the new Monster Silk produced by transgenic silkworms, which includes certain spider silk proteins as well as silk proteins. The result is a significantly stronger, more elastic product that can be produced at a cost comparable to that of conventional silk.

Similar breakthroughs are appearing for man-mades — some of them including increasing ability to weave them into cloth that was previously 100-percent natural. These new blends are showing up in more and more products ranging from mass market types all the way to top-end fashion offerings.

Still elsewhere, more and more lighter and longer-lasting nonwovens are being introduced in a variety of fields including packaging and autos. In the latter case, one study suggested that more than 40 individual parts now are being made using these nonwovens, principally to allow increased vehicle efficiency, effect cost savings, reduce energy consumption and improve acoustical insulation.

All in all, these and other so-called technical fibers are now said to account for 25 percent of global fiber consumption. And they’re being applied to a growing number of other areas like water purification, medicinal products and responsive fibrous systems.

When it comes to the medical field, for example, new offerings are being designed for less-invasive surgical procedures, infection control, and accelerated healing. And for outside wear, there now are garments that can take a child’s biometrics and then text them to a cell phone.

More attention also is being given to leisure-time products. And with good reason. Specifically, a growing number of consumers who exercise regularly say they’re looking for technologies that ensure they stay cool and dry during workouts.

These innovations are not limited to fibers, fabrics and apparel performance. For one, there are all the new digital technologies designed to transform the buying experience — all aimed at generating higher sales. They include paperless receipts, signing for purchases on a touch screen, and ordering online and then picking up the item at a store.

Still another wrinkle in the digital sphere, is the availability of virtual fitting rooms, some of which even create 3-D models while a buyer shops online. By making the choice and the right size as quickly as possible, it gives customers a lot of incentive to make an immediate purchase.

Some fashion firms are even experimenting with performance-tracking technology. It’s already in use in online shopping when buyers receive recommendations based on past selections.

Finally, if there’s still any doubt about putting more effort into online selling, they should be quickly dispelled by a recent e-commerce survey. It finds that consumers spend 100 minutes a month shopping online, significantly more than spent in brick and mortar stores.

Other Useful Strategies

Clearly, textile and apparel firms are leaving no stone unturned in their efforts to bolster consumer buying. Thus, aside from the just-discussed new and improved products and digital enhancements, there also are some other successful approaches being used to beef up demand and assure better bottom line performances.

One getting a lot of attention these days is more and more emphasis on the environment. A recent survey finds nearly 7 out of 10 consumers would be bothered if they discovered an apparel item they purchased was not environmentally friendly. Equally notable, about 4 out of 10 would blame the manufacturer for any ecological shortcoming.

Another potential plus here: More than one-third of queried buyers say they would be willing to pay more for clothing labeled “environmentally friendly” or “sustainable.”

In any case, an increasing number of companies are addressing such issues as toxins, waste and the amount of water used for production. Nike, for example, has created and is sharing its Environmental Apparel Design Tool, which scores and compares designs in terms of waste and the use of ecologically friendly materials.

Another interesting development: More clothing now is coming in small, medium and large sizes. Indeed, shop at almost any clothing store these days, and you’ll see more letters and fewer numbers on its products.

Termed “alpha sizing,” this also is a plus for manufacturers and retailers. It makes online shopping more efficient, minimizes a shopper’s practice of ordering two different sizes and then returning, and simplifies the translation of international sizes.

As one clothing making put it, “If I have to provide a few instead of many sizes, my supply chain is going to be much more efficient.”

Still another industry supply chain plus has been the investment in new technologies that speed delivery. And make no mistake here — it’s important because fast fashion has pushed speed-to-market from as long as six to nine months to only around six weeks.

These reduced lead times can have a major impact on bottom lines. As one industry executive recently put it, supply chain leaders have an almost 10 point advantage on profit margins vis-á-vis industry laggards.

Washington, too, can play a role in propelling the industry forward. Just a few months ago, NCTO called on lawmakers to adapt meaningful legislation to stop predatory currency pricing. One study figured that doing so could create millions of new U.S. manufacturing jobs.

NCTO also is pressing Congress on a bill that would temporarily suspend duties on manufacturing imports of materials that are not made domestically. The aim is to increase the competitiveness of domestic textile products.

But, as noted earlier, the most encouraging sign of all is probably the fact that our textile and apparel producers lead the world in research and product development. By and large, U.S. producers are spearheading this work by introduction of such innovative offerings as conductive fibers, antimicrobial fibers, antiballistic body armor and even garments that adapt to climate change. Moreover, a lot more is on the drawing boards.

One thing for sure, all these efforts are paying off. TW, for example, now expects industry shipments to rise close to 2 percent per year through the end of the decade. In fact, this estimate may well turn out to be somewhat on the conservative side given the cumulative impact of a better understanding of the advantages of reshoring, growing consumer pressure to buy American, technological breakthroughs and even the cooperation of domestic retailers.

All of these factors clearly played a role in the recent decision by an American hosiery manufacturer to reopen its North Carolina plant.

Especially significant here was the role played by Walmart who wants to reduce its heavy reliance on imports. Indeed, the hosiery company says that Walmart’s enthusiasm was probably the tipping point in its decision to reopen.

Summing it all up: The evidence is crystal clear. All signs are now pointing to a brighter future for U.S. textile and apparel industries.

January/February 2015