The International Textile Machinery Manufacturers Federation (ITMF) Director General Dr. Christian Schindler shares his thoughts about the organization and the textile industry ahead of the 2024 ITMF annual conference.

TW Special Report

The International Textile Manufacturers Federation (ITMF) is a Switzerland-based organization dedicated to the global textile industry. Its mission statement includes a commitment to connect, inform and represent its member companies all with a mind to strengthen relations both within and outside of the textile industry.

Member companies are able to cooperate on an international level with other members as well as organizations representing sectors allied to their industries. ITMF provides members with surveys, studies and publications, and also hosts an annual conference for learning and networking opportunities.

Dr. Christian Schindler is director general of ITMF. He recently chatted with Textile World about the organization, benefits of membership and ITMF’s upcoming annual conference to be held later this year in Uzbekistan, among other topics.

Textile World: ITMF has attracted a diverse group of members. Why do members join? What are the benefits of membership?

Schindler: ITMF is a platform for the entire textile value chain spanning all segments from fiber producers to producers of home textiles and garments including textile machinery producers and even retailers. Associations and companies join ITMF because they benefit from a unique set of statistics, reports and surveys, as well as from a unique network that looks at the entire textile value chain. Being part of a global network helps international-oriented companies to better under-stand the dynamics of the global textile value chain. Building an international network of colleagues and friends is an important aspect of joining ITMF.

TW: Please tell readers who are unfamiliar with ITMF about the data that ITMF collects and the publications and reports that are available to members.

Schindler: There are several statistics that ITMF publishes on a regular basis. First, for around 50 years, ITMF has published the annual so called “International Textile Machinery Shipment Statistics” (ITMSS), which is a compilation of shipments of new textile machinery to any country in the world. This publication illustrates how many new ring-spindles, rotors, texturing spindles, shuttleless looms, large circular knitting machines or tenters were shipped to any country in any given year. People can see the investment intensities as well as the major investment destinations.

Second, the so called “International Production Cost Comparison” (IPCC) has been published every other year since the 1980s. In this publication, the production costs in U.S. dollars of yarns down to the finished fabrics are compared in 14 different countries/regions around the world. This publication helps to understand the cost competitiveness of a country/region.

Third, ITMF’s “Global Textile Industry Survey” (GTIS), which is conducted every other month, provides the entire textile value chain with information about the state and outlook of the industry covering all segments from fiber producers to producers of home textiles, garments and technical textiles and regions from South America to East Asia. There are also other publications like the “International Textile Industry Statistics” (ITIS) that provides data about machinery capacities and fiber consumption in countries around the world.

TW: What were the main results of the 26th GTIS, the most recent survey as of TW’s press time?

TW: What were the main results of the 26th GTIS, the most recent survey as of TW’s press time?

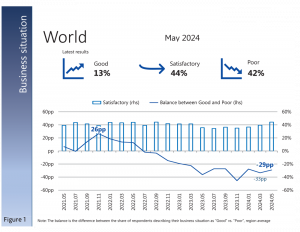

Schindler: ITMF’s 26th GTIS clearly highlighted that the entire textile value chain is faced with a very difficult business situation. As the graph shows (see Figure 1), the balance between companies claiming to have a “good” business situation — 13 percent — and a “poor” one — 42 percent — is -29 percentage points (pp). Business expectations remained positive at +25pp, which is what we saw in the March survey.

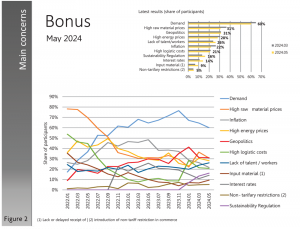

The reason for this lack-luster business situation is the lack of demand and higher costs for energy, raw materials, logistics, labor, or capital which is weighing heavily on companies’ profit margins (See Figure 2). Of course, geopolitics with wars in Ukraine and Gaza were, and are, not helping to improve business and consumer confidence.

Nevertheless, the survey also revealed that there are more companies seeing a more favorable business environment in six months— 36 percent — than a less favorable one — 11 percent. But it seems also clear that there will only be a gradual improvement given the fact that 53 percent of respondents expect that the business situation will be unchanged in six months. It can be said that there is the hope that the downward cycle that started at the end of 2022 is coming to an end in 2024, which can be regarded as a transition year.

TW: As someone with an inherent international perspective, how do you perceive each of the active economic areas — North America, Mexico, Central and South America, Europe, China, India and Southeast Asia — in terms of opportunities, challenges, growth and specialization? Any specific areas that could be high-lighted for strong growth or a lack of growth?”

Schindler: I think that the U.S. economy is the one that has outperformed all developed economies in 2023 and continues going strong in 2024. While demand remains relatively strong, the U.S. retail industry was, and still is, sitting on inventory that was built up in 2021 and 2022. Once inventories move back to normal levels — and they are slowing coming down since the end of 2022 — brands and retailers will start placing more orders again. Another country that is seeing strong growth is India, which was the fastest growing developing country in 2023.The country has a strong domestic market whose retail market is becoming more and more mature and continues growing driven by demographics and by attracting more and more investments. Therefore, it provides a lot of opportunities to the textile and apparel industry. China has seen a decent growth in 2023, albeit from low 2022 levels. The country is still by far the largest producer of textiles and apparel and has an enormous domestic market to serve. Nevertheless, the country is faced with challenges like a shrinking population, a troubled real estate market, a deflationary tendency and persistent youth unemployment. Europe is still struggling the most as it was more strongly impacted by rising energy prices. Just like in 2023, the world economy is growing at around 3 percent in 2024. This is lower than the historic level of almost 4 percent between 2010-2019.

TW: The United States is in an election year and inflation is in the news even in the textile industry. Is inflation a global issue at the moment? Is inflation affecting European machinery manufacturers and/or affecting investment in various regions?

TW: The United States is in an election year and inflation is in the news even in the textile industry. Is inflation a global issue at the moment? Is inflation affecting European machinery manufacturers and/or affecting investment in various regions?

Schindler: In general, inflation is a global phenomenon that was fueled by several factors. Fiscal and monetary policies around the world were expansionary at the start of the pandemic which provided companies and consumers with a lot of needed support. While demand surged in 2021 and 2022, supply chains were disrupted and sometimes broken. Products or semi-products were in high demand that supply could not meet, and shipping containers were not where they were needed, for example.

All this led to supply and demand imbalances that resulted in rising prices. Furthermore, rising energy prices in the aftermath of Russia’s invasion of Ukraine in February 2022 added to higher costs and dampened demand. As of the end of 2022, the textile and textile machinery industries found themselves in a perfect storm of rising costs and dwindling demand. Consumers saw their disposable income fall in 2023. But with inflation falling back significantly since the peak in early 2023 and higher nominal wages across many industries, real wages are growing again which should eventually strengthen demand. As for investments, textile machinery companies are struggling just like textile companies. In 2023, some machinery producers benefited from a long order backlog, while order income remained low. Given the low order intake in the textile industry, only companies with a solid balance sheet will be able to invest now and prepare for the upswing that will eventually come.

TW: In September, ITMF will host its annual conference, which for the first time will be held jointly with the International Apparel Federation (IAF). What are the benefits of hosting a joint event with the IAF?

Schindler: The main benefit is that we will have one event for the global textile value chain and that all those persons that are affiliated with both organizations will only need to travel once. Furthermore, the strength of two organizations coming together for one event will provide additional insights for each other’s members.

TW: Why Uzbekistan and what unique opportunities does the location offer? How does hosting the event benefit the textile industry in Uzbekistan?

Schindler: Uzbekistan has seen enormous change in the last 10 years, especially since the new president, Mr. Shavkat Mirziyoyev, started to transform and open the country. The number of private investments in the cotton, textile and apparel industry is significant. ITMF’s International Textile Machinery Shipment Statistics reveals that especially in cotton spinning machinery Uzbekistan — with a population of around 35 million — was among the five biggest investors during the past 10 years. But also in the other downstream segments, a lot of investments took place. Worth noting is the important fact that Uzbekistan was also able to get rid of the so-called cotton ban in 2022, introduced in 2010 by the cotton campaign, a coalition of human rights NGOs, independent trade unions, brand associations, responsible investors and academics. Uzbekistan is the “new kid on the block” that offers interesting sourcing alternatives being located between China, India and Europe.

TW: For someone who has never attended an ITMF annual conference before, what can they expect from the event?What are your hopes for the attendees?

Schindler: First, all attendees will learn of course a lot about the Uzbek textile and apparel industry, but also about the country that is one of the safest countries in the world and that it offers a lot of history and culture as well as very divers and attractive landscape. Second, the conference will cover very important topics like how regulations in different regions will impact the global textile industry, and how innovation and collaboration will shape the way companies will produce and serve markets. The general theme “Innovation, Collaboration & Regulation — Drivers of the Textile & Apparel Industry” will serve as a guideline for the discussions among industry experts. One important aspect of the ITMF & IAF Conference 2024 is certainly the unique opportunity to meet colleagues and friends from around the world from the entire textile value chain.

2024 Quarterly Volume III