Wovens, knits and nonwovens all find applications in medical products.

By Jim Kaufmann

Why all the interest in medical textiles,” you might ask? Could it be that the use of medical textiles continues to grow at an astounding rate and there appears to be no end in sight? Could it be that virtually every form of textile fiber and/or textile manufacturing technology is at play in some medical textile application or another? Could it be increased efforts to improve health and hygiene programs globally? Could it basically be that most humans want to live longer and continue to lead productive lives? Could it just be a good business proposition in that higher life expectancy coupled with continued population growth will only advance the use of medical textiles and foster even more new opportunities? Or, most likely, could it simply be some combination of all of the above?

Medical textiles, according to www.technicaltextiles.net, are “manufactured goods which include textile stuff used in hygiene, healthiness and private care, as well as surgical end uses.” In other words, the medical textiles marketplace is a large, rather complex and extremely diverse sector of the technical textiles and nonwovens industry. It’s comprised of numerous product categories, segments, sub-segments and sub-sub-segments. Products encompass a variety of different shapes, sizes and configurations. Some categories — like diapers and wipes — are multi-billion-dollar industry segments unto themselves, while other categories — such as surgical implants, research and development projects and other small-scale activities —represent segments with less than $100,000 in annual sales, and then there are segments representing pretty much everything in between. In greatly simplified terms, each of these assorted segments fall largely into two primary categories, outside the body and inside the body.

Applications Outside The Body

Outside the body comprises the broadest and largest markets. Notable market segments include wound care, compression, barrier and hygiene products — items that most consumers are familiar with. These segments typically generate higher volumes, but also result in comparatively lower profit margins. They include mass market branded and generic versions and are available from many large and well-known manufacturers. Representative products may or may not come into contact with the skin during use. Technologies generally are specific to the application, but most applications likely will require some level of testing and qualification prior to acceptance for use.

Wound care products are used to foster healing; prevent infection; and to protect cuts, incisions, scrapes, burns and other similar injuries or concerns. Specific products in branded or generic varieties include bandages and other wound dressings, wraps and plasters for making casts, medical tapes, gauze, wadding and absorbent pads, and other similar items. Compression products generally are used to stabilize, contain and aid or restrict movement in targeted areas of the body. These mostly are branded products that include sleeves, tights, socks, support hosiery and wraps. Most incorporate elastic yarns with knit or woven geometries to create and direct compressive forces where necessary. Barrier products include protective garments and textiles used largely in hospitals, healthcare facilities and operating rooms to prevent exposure to bodily fluids or gases, and to reduce any possibilities of contamination, infection and other related concerns. Surgical gowns, gloves, masks, aprons and related items used in operating rooms along with blankets, sheets, pillow covers, furniture covers and other products throughout the hospital and health care facilities also fall into this category.

Hygiene products, by far the largest segment of outside the body applications, encompasses huge markets and generates the largest total revenues for both branded and generic products. These products generally are items intended to promote a better lifestyle experience as well as convenience. Products include feminine care, sanitary napkins, panty shields, baby diapers, adult incontinence items and a variety of wipes. In general, hygiene products largely are made using nonwovens and often incorporate highly technical polymers and fibers capable of absorbing great amounts of liquid over a given unit of size.

It’s anticipated that the outside the body applications referenced above will continue to show growth and opportunity because of several factors that do not show signs of any immediate changes. The world’s population continues to get older as the baby boomer generation approaches retirement age. For example, it is predicted that in the next 10 years or so, adult diapers might surpass infant diapers in sales volumes. The aging population is creating increases in the number of hospitals and remedial health-care centers globally. This, coupled with an increase in support centers for the elderly such as assisted living centers and senior communities, translates into a seniors population that is healthier and much more active compared to previous generations.

Large amounts of research dollars continue to be spent in virtually all medical textile segments and are being directed across a variety of activities. One of the biggest areas of focus centers on improving the disposability, sustainability and environmental sensitivity of hygiene products. As hygiene segment volumes continue to grow in parallel to environmental concerns, safe and sustainable disposal will continue to be a concern. Similar efforts targeted at creating a more sustainable environment are driving new research into reusability, sterilization, decontamination and antimicrobial treatments for barrier products as well. Other research activities include the further development of even more super-absorbable fiber technologies, improved product design and comfort, and the never-ending quest for more cost effective processing technologies throughout the supply chain.

Applications Inside The Body

In contrast to the large volumes, relatively low margins and recognizable brand names found in outside the body applications, inside the body or implantable applications — implantables — are used to affect repairs to the body in some manner. These applications generate relatively low volumes — in some special cases less then 10 units per year — but offer rather high margins comparatively. Implantables — including sutures, heart valves, hernia mesh, artificial ligaments, vascular grafts and artificial joints — tend to be highly specialized, wholly performance-based and application specific. Given that implantables are to be inserted into the human body, it is understood that each device has a clearly defined technical specification, and — within the United States at least — will require an extensive qualification, approval process, and quality manufacturing and traceability standards. Also, any raw materials used to make these products will have to go through similar qualifications and approvals. Implantables can be made from either resorbable or non-resorbable fibers. Resorbable fibers are designed and produced from polymers that will decompose and be absorbed into or pass through the human body. Conversely, non-resorbable fibers do not decompose in the body and when implanted become permanent additions unless physically removed at a later date.

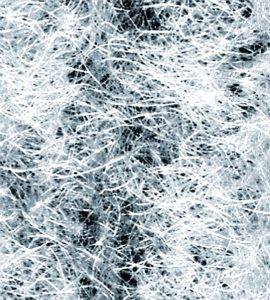

Implantable components attempt to mimic the body’s native structures and are intended to foster a rapid integration when used. In order to mimic the body’s functionality, they are engineered with localized dimensional stability, elasticity, porosity and other specific physical requirements depending on the application. Implantables need to be biocompatible, non-toxic, anti-allergenic and anti-bacterial during their lifecycle usage. All implantable products likely will have an extensive qualification process, which is specific to each application. In many cases, it could take years to qualify a product prior to production and can be very costly.

Somewhere In-Between Outside And Inside The Body

Prosthetics, orthotics and extracorporeal devices are medical product segments that do not quite fall within either the outside the body or inside the body categories but are still medical devices integral to improving the human experience. Extracorporeal devices are essentially mechanical filtration units that use textiles largely as filtration media to support the function of vital organs. These include artificial kidney and liver devices along with mechanical lungs among others. Prosthetics devices are designed to replace missing body parts while providing a level of functionality. In contrast, orthotic items are largely used as corrective devices such as insoles and braces to improve functional characteristics of the neuromuscular or skeletal systems. Prosthetics have been receiving increased attention and publicity in recent years due in large part to injuries suffered in wars and conflict zones. Many of the newer prosthetic devices incorporate composite elements to reduce weight, improve fit and enhance functionality. Newer advanced textile systems also are being used to improve the interface between the device and human tissue and nerve systems.

Nuances And A Bright Future

A few words of caution before taking the big leap into the medical textiles arena. As mentioned earlier, qualification, approval and acceptance of medical textile products into service can be an extensive, time consuming and expensive endeavor. As such, intellectual property protection is important and used broadly throughout all levels of the supply chain. Product quality, performance and consistency are absolutely critical in any implantable medical product. Any issues experienced by a recipient could result in sickness, trauma and possibly death, which could lead to difficult malpractice lawsuits, product recalls or pretty much any variation thereof. All of which can become incredibly expensive and none of which are pleasant to deal with.

In addition to large companies, there’s quite an array of small companies, universities and individuals working to develop new technologies for medical textile applications. Most research projects are noble pursuits, however some researchers simply are on a mission fueled by a personal connection. Others are looking to be acquired by a larger company, whether to acquire technology for use, or as a means to eliminate competitor technologies and a few others are simply hoping for that golden lottery ticket. In other words, extensive due diligence is absolutely imperative for any company interested in getting into the medical textiles marketplace.

It’s clear there’s a lot going on in medical textiles and the trends all point to this continuing well into the future. Significant amounts of development dollars are being spent in virtually all medical textiles product segments to further advance technologies, gain or maintain a competitive edge and to make products more efficiently and at a lower cost. Advancing technologies include drug delivery systems designed to administer various drugs in controlled doses and targeted locations, less obtrusive delivery systems for biomedical device implantables and potentially the incorporation of electronics within the implantables to monitor functionality and improve nerve and muscular integrations. Add in the continuing development of even more exotic fiber types and shape memory materials along with various efforts at tissue engineering and growth scaffolds along with a whole host of other activities, and it’s easy to see that medical textiles have come a long way and there’s still more to be done.

November/December 2016